no closing cost refinance florida: what to know before you apply

Understanding how it works

A “no closing cost” refi often means the lender covers fees using credits in exchange for a slightly higher rate, or rolls costs into the balance. That can be smart if you’ll sell or refinance soon, but long-term borrowers may pay more interest. Ask for a detailed Lender Credit breakdown.

Common mistakes to avoid

- Chasing the lowest payment while ignoring total lifetime cost and APR.

- Not comparing identical rate lock terms, points, and escrows across quotes.

- Assuming “no cost” includes prepaids like taxes and insurance-it usually doesn’t.

- Skipping appraisal waivers or condo questionnaires that could change pricing.

- Refinancing near payoff without checking break-even and recoup timeline.

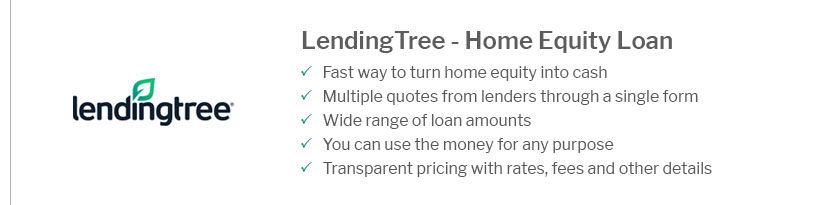

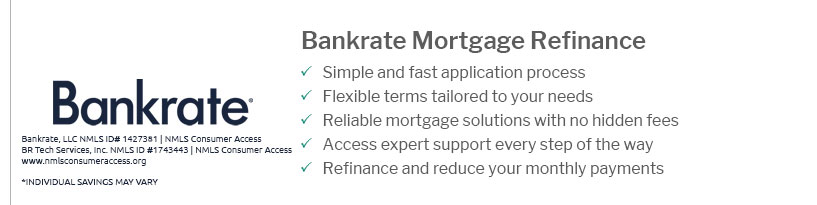

Comparing your options

Request a side-by-side with: the par-rate option, a credit-funded “no cost,” and one with points. Evaluate APR, cash-to-close, and projected five-year cost. If rates drop, a no-cost refi can keep flexibility; if you’ll keep the home, a lower rate with some fees may win.

Florida-specific tips

Confirm homestead status, condo and HOA requirements, wind mitigation credits, and insurance premiums-common Florida variables that affect escrows and approvals. Ask about faster title searches and remote online closings to avoid delays during peak storm seasons.